News

-

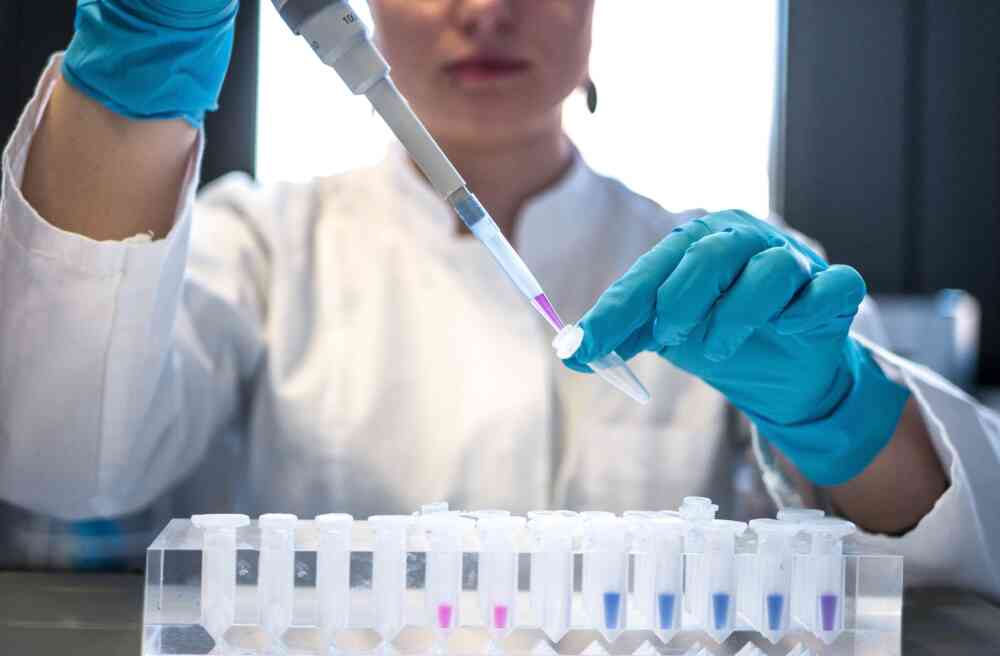

Socius team gears up for the London Marathon to support cancer research

Socius team gears up for the London Marathon to support cancer research -

Socius welcomes Katrina to the team!

Socius welcomes Katrina to the team! -

Healthy planet, healthy places, healthy people writes Juliette Morgan

Healthy planet, healthy places, healthy people writes Juliette Morgan -

Collaboration achieves better outcomes

Collaboration achieves better outcomes -

The Power of Partnerships

The Power of Partnerships -

Daniel May reflects on his time at MIPIM

Daniel May reflects on his time at MIPIM -

The future of Retrofit

The future of Retrofit -

Cities need new buildings, argues Earle Arney

Cities need new buildings, argues Earle Arney -

Edward Street Quarter featured in Property Week

Edward Street Quarter featured in Property Week -

Socius Cancer Charity Challenge 2024

Socius Cancer Charity Challenge 2024 -

Our B Corp Journey

Our B Corp Journey -

Workplaces should resonate with our humanity argues Despina Katsikakis

Workplaces should resonate with our humanity argues Despina Katsikakis -

Contractors appointed for Cambridge developments

Contractors appointed for Cambridge developments -

We’re proud to partner with Regeneration Brainery at UKREiiF 2024

We’re proud to partner with Regeneration Brainery at UKREiiF 2024 -

Investing in Social Impact

Investing in Social Impact -

Problem solving gives you an edge, says Peter Rogers

Problem solving gives you an edge, says Peter Rogers -

Dreamball Draw winners experience magical Lapland!

Dreamball Draw winners experience magical Lapland! -

Build To Rent – means better homes argues Polly Simpson

Build To Rent – means better homes argues Polly Simpson -

Socius & Aviva to deliver world leading cancer and research district

Socius & Aviva to deliver world leading cancer and research district -

Looking forward to a great 2024

Looking forward to a great 2024 -

Urban theatre with Simon Allford

Urban theatre with Simon Allford -

2023 unwrapped: a year of highlights, triumphs and milestones

2023 unwrapped: a year of highlights, triumphs and milestones -

DEI in the real estate industry

DEI in the real estate industry -

National Tree Week: Tree Donations at Parker’s Piece

National Tree Week: Tree Donations at Parker’s Piece -

Socius celebrates formation day on Giving Tuesday

Socius celebrates formation day on Giving Tuesday -

Let’s talk about the value of trees

Let’s talk about the value of trees -

Cambridge project partners showcase sustainable careers at ‘Green Skills Fair’

Cambridge project partners showcase sustainable careers at ‘Green Skills Fair’ -

Plans for sustainable and intelligent workspace in Cambridge approved by City Council

Plans for sustainable and intelligent workspace in Cambridge approved by City Council -

Socius celebrates second successful Emerging Talent placement

Socius celebrates second successful Emerging Talent placement -

"Are you a YIMBY?", "Yes".

"Are you a YIMBY?", "Yes". -

Aviva and Socius announce plans for world leading cancer research district in Sutton

Aviva and Socius announce plans for world leading cancer research district in Sutton -

MK Gateway team saves 1,500 heritage plants

MK Gateway team saves 1,500 heritage plants -

Soapworks supports project partner, Arup to deliver Social Value

Soapworks supports project partner, Arup to deliver Social Value -

Opportunity knocks for Olaide at Monocle’s Quality of Life Conference

Opportunity knocks for Olaide at Monocle’s Quality of Life Conference -

MD Barry Jessup on growing and nurturing ecosystems

MD Barry Jessup on growing and nurturing ecosystems -

Partnership helps deliver shared Social Value ambitions

Partnership helps deliver shared Social Value ambitions -

Socius shortlisted for ‘Developer of the Year’ Award

Socius shortlisted for ‘Developer of the Year’ Award -

Luke Martin ‘gives back’ to help end youth homelessness

Luke Martin ‘gives back’ to help end youth homelessness -

Barry talks motivation, down time and the responsibility to ‘do things better’ in our latest Podcast

Barry talks motivation, down time and the responsibility to ‘do things better’ in our latest Podcast -

Socius welcomes University of Cambridge masters’ students to Edward Street Quarter

Socius welcomes University of Cambridge masters’ students to Edward Street Quarter -

Work experience provides the opportunity to learn from Socius

Work experience provides the opportunity to learn from Socius -

Socius goes back to school to help students learn more about real estate

Socius goes back to school to help students learn more about real estate -

Housing plans ‘consistently underestimate’ the importance of placemaking

Housing plans ‘consistently underestimate’ the importance of placemaking -

New offices at Edward Street Quarter 90% Let

New offices at Edward Street Quarter 90% Let -

Social Value Symposium inspires conversations around maximising Impact

Social Value Symposium inspires conversations around maximising Impact -

Edward Street Quarter Wins Insider South East Property Award

Edward Street Quarter Wins Insider South East Property Award -

Construction News Awards sees social value prioritised

Construction News Awards sees social value prioritised -

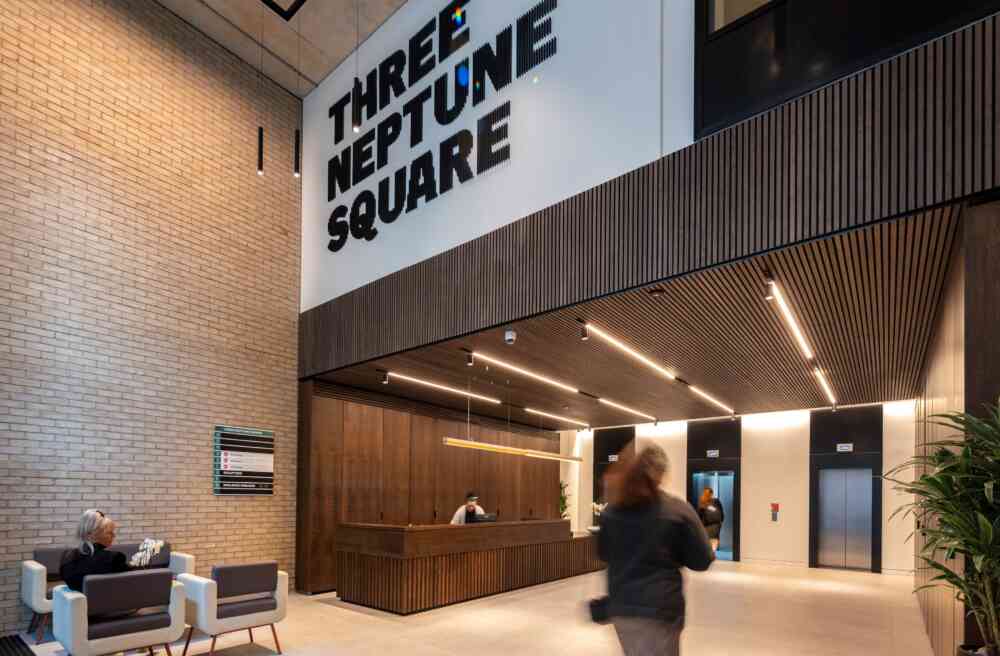

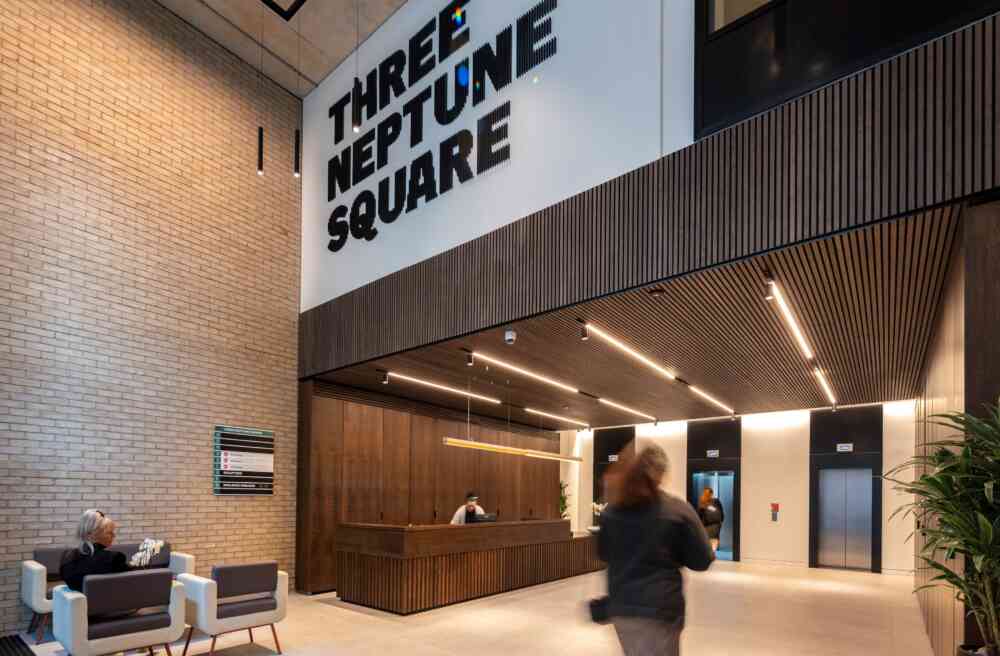

Socius tells React News “it’s time for Grade A* office space”

Socius tells React News “it’s time for Grade A* office space” -

Beds, Meds, Sheds and...? Barry shares his thoughts with BisNow

Beds, Meds, Sheds and...? Barry shares his thoughts with BisNow -

Planning amendments for Botanic Place submitted

Planning amendments for Botanic Place submitted -

We hear from Vic, aka ‘the one who runs the business’ in our new ‘So Say Us’ Podcast

We hear from Vic, aka ‘the one who runs the business’ in our new ‘So Say Us’ Podcast -

Students with social, emotional and mental health (SEMH) needs lead school landscaping project

Students with social, emotional and mental health (SEMH) needs lead school landscaping project -

Andy Shamash gets closer to nature on his ‘giving back’ days

Andy Shamash gets closer to nature on his ‘giving back’ days -

“A shopping trip changed my whole life!” says Nicola Marks in our latest ‘So Say Us’ Podcast

“A shopping trip changed my whole life!” says Nicola Marks in our latest ‘So Say Us’ Podcast -

Steve Eccles is committed to ‘giving back’ to communities

Steve Eccles is committed to ‘giving back’ to communities -

Monocle celebrates Socius for changing peoples lives

Monocle celebrates Socius for changing peoples lives -

Connecting through culture as we age

Connecting through culture as we age -

Estate Manager, Nicola never wants to retire!... find out why in our ‘So Say Us’ Podcast

Estate Manager, Nicola never wants to retire!... find out why in our ‘So Say Us’ Podcast -

Leila shares her Emerging Talent Placement experience

Leila shares her Emerging Talent Placement experience -

EG Interview with Barry and Olaide

EG Interview with Barry and Olaide -

MK Gateway features on Property Week Front Page

MK Gateway features on Property Week Front Page -

CoStar Impact Award goes to Edward Street Quarter

CoStar Impact Award goes to Edward Street Quarter -

Liam shares his love of music and Sheffield Wednesday in latest ‘So Say Us’ podcast

-

What can Socius do to help you deliver more social value?

What can Socius do to help you deliver more social value? -

Olaide and Steve talk all things Socius in our latest ‘So Say Us’ Podcast

Olaide and Steve talk all things Socius in our latest ‘So Say Us’ Podcast -

We’re proud to be changing lives for the better

We’re proud to be changing lives for the better -

Members Hill wins planning consent

Members Hill wins planning consent -

Our first-ever ‘So Say Us’ podcast is AVAILABLE NOW!

Our first-ever ‘So Say Us’ podcast is AVAILABLE NOW! -

Meet Team Socius: Senior Project Manager, Joel Colthart

Meet Team Socius: Senior Project Manager, Joel Colthart -

Socius Dreamball Draw awards Jamaica trip!

Socius Dreamball Draw awards Jamaica trip! -

Listen to the preview of our new ‘So Say Us’ Podcast series

Listen to the preview of our new ‘So Say Us’ Podcast series -

Olaide discusses social impact on PropCast: The Property Podcast

Olaide discusses social impact on PropCast: The Property Podcast -

Mike Dodd shares his faves with Bristol Business News

Mike Dodd shares his faves with Bristol Business News -

Daniel May reflects on Boston's Life Sciences offering

Daniel May reflects on Boston's Life Sciences offering -

Exclusive tour of newly opened Edward Street Quarter

Exclusive tour of newly opened Edward Street Quarter -

Creating Social Value through Property Development

Creating Social Value through Property Development -

Socius and Railpen partner on Botanic Place

Socius and Railpen partner on Botanic Place -

Red wine, live music and WFO are Barry's 2023 predictions

Red wine, live music and WFO are Barry's 2023 predictions -

Prioritising the S in ESG

Prioritising the S in ESG -

Happy New Year!

Happy New Year! -

Merry Christmas!

Merry Christmas! -

Team Socius mark one year with a volunteering push

Team Socius mark one year with a volunteering push -

What can property learn from I'm a Celebrity?

What can property learn from I'm a Celebrity? -

Is there a place for Women in Property?

Is there a place for Women in Property? -

Socius supports local businesses to succeed

Socius supports local businesses to succeed -

Meet Team Socius: Managing Director, Barry Jessup

Meet Team Socius: Managing Director, Barry Jessup -

Liam Ronan-Chlond 'Sleeps Out to Help Out'

Liam Ronan-Chlond 'Sleeps Out to Help Out' -

Daniel May shares learnings from Life Sciences in Boston

Daniel May shares learnings from Life Sciences in Boston -

Socius view on the Oxford to Cambridge Arc

Socius view on the Oxford to Cambridge Arc -

Environmental experts partner on Devonshire Gardens

Environmental experts partner on Devonshire Gardens -

Back in the office (well, sort of…)

Back in the office (well, sort of…) -

Edward Street Quarter welcomes first residents

Edward Street Quarter welcomes first residents -

Positive workplace culture sees Socius support secondment

Positive workplace culture sees Socius support secondment -

Riding the rollercoaster Conversative Party Conference

Riding the rollercoaster Conversative Party Conference -

The ‘paying it forward’ effect

The ‘paying it forward’ effect -

Is this Labour’s “Moment”?

Is this Labour’s “Moment”? -

ESQ shortlisted for 'Storytelling' in Archiboo Awards

ESQ shortlisted for 'Storytelling' in Archiboo Awards -

Plans submitted for Member's Hill

Plans submitted for Member's Hill -

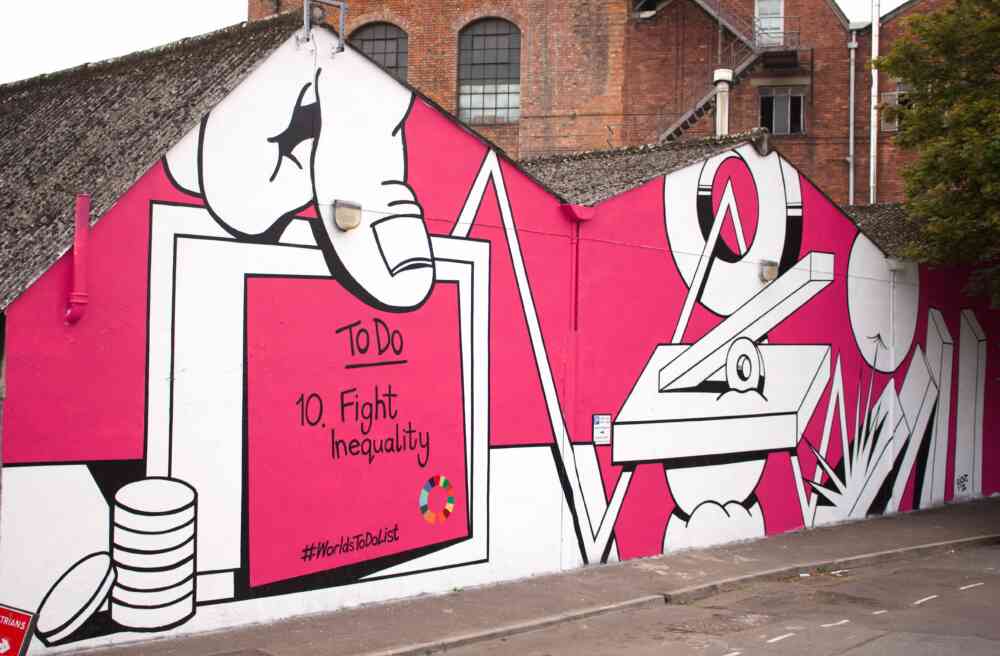

Soapworks supports the 'World's To-Do List' campaign

Soapworks supports the 'World's To-Do List' campaign -

Congrats to Liam on Social Value qualification

Congrats to Liam on Social Value qualification -

Socius welcomes Mike Dodd to the development team

Socius welcomes Mike Dodd to the development team -

Death of Her Majesty Queen Elizabeth II

Death of Her Majesty Queen Elizabeth II -

Long Time Project inspires property industry to take a Future-Focused approach

Long Time Project inspires property industry to take a Future-Focused approach -

Read all about Eoin Morris' work experience with Socius

Read all about Eoin Morris' work experience with Socius -

Welcome to the team Ashley Broderick!

Welcome to the team Ashley Broderick! -

Devonshire Gardens plans approved

Devonshire Gardens plans approved -

Olaide Oboh recognised as 'The Community Champion' by Bisnow

Olaide Oboh recognised as 'The Community Champion' by Bisnow -

Liam selected to join the Social Value UK Advisory Board

Liam selected to join the Social Value UK Advisory Board -

The true value of business success is priceless!

The true value of business success is priceless! -

Edward Street Quarter delivers more than £15m of local benefits

-

Meet Team Socius: Business Development Executive, Victoria Birks

Meet Team Socius: Business Development Executive, Victoria Birks -

Gardening equipment donated to budding horticulturalists

Gardening equipment donated to budding horticulturalists -

Bricks revealed at Edward Street Quarter

Bricks revealed at Edward Street Quarter -

Local partners help us build meaningful connections within communities

Local partners help us build meaningful connections within communities -

Property Week reports on lettings at Edward Street Quarter

Property Week reports on lettings at Edward Street Quarter -

Lush green rooftops at MK Gateway

Lush green rooftops at MK Gateway -

'Experience is everything' writes Barry Jessup

'Experience is everything' writes Barry Jessup -

Happiness is finding a healthy balance

Happiness is finding a healthy balance -

Meet Team Socius: Head of Engagement, Liam Ronan-Chlond

Meet Team Socius: Head of Engagement, Liam Ronan-Chlond -

Sustainable Cambridge plans submitted

Sustainable Cambridge plans submitted -

The City of Milton Keynes

The City of Milton Keynes -

Milton Keynes to take centre stage at UKREiiF

Milton Keynes to take centre stage at UKREiiF -

Social impact survey encourage others to act

Social impact survey encourage others to act -

Have you spotted Brighton's boldest new landmark?

Have you spotted Brighton's boldest new landmark? -

Daniel May shares how he 'gives back' to his local community

Daniel May shares how he 'gives back' to his local community -

Why doing good is good for business

Why doing good is good for business -

Cambridge artists showcase sustainability inspired art

Cambridge artists showcase sustainability inspired art -

MK Gateway shortlisted in 2022 Planning Awards

MK Gateway shortlisted in 2022 Planning Awards -

The only way is brownfield

The only way is brownfield -

Barings joins Socius to take forward Soapworks

Barings joins Socius to take forward Soapworks -

Socius takes the lead on 10 acre redevelopment in Brooklands, Surrey

Socius takes the lead on 10 acre redevelopment in Brooklands, Surrey -

Socius' tech focused consultation featured in EG

Socius' tech focused consultation featured in EG -

Barry Jessup debates the role of senior living in urban centres

Barry Jessup debates the role of senior living in urban centres -

B-Corp month is here!

B-Corp month is here! -

Buyers flock to launch of Edward Street Quarter homes

Buyers flock to launch of Edward Street Quarter homes -

Genuine local engagement will be vital for the Oxford-Cambridge Arc

Genuine local engagement will be vital for the Oxford-Cambridge Arc -

Live your best Brighton life at Edward Street Quarter

Live your best Brighton life at Edward Street Quarter -

Olaide Oboh debates the future of cars with BisNow

Olaide Oboh debates the future of cars with BisNow -

First sunset shots taken from Edward Street Quarter

First sunset shots taken from Edward Street Quarter -

MK Gateway sets a new standard for BTR

MK Gateway sets a new standard for BTR -

Doug Higgins discusses 'The New Sustainable Retail Experience'

Doug Higgins discusses 'The New Sustainable Retail Experience' -

Socius welcomes Luke Martin to Bristol office

Socius welcomes Luke Martin to Bristol office -

Barry Jessup discusses the future of the office in Property Week

Barry Jessup discusses the future of the office in Property Week -

Our predictions for 2022 - ‘what’s in store’ and ‘what to look out for’

Our predictions for 2022 - ‘what’s in store’ and ‘what to look out for’ -

Olaide Oboh makes the Estates Gazette Most Influential list

Olaide Oboh makes the Estates Gazette Most Influential list -

Ship’s hull inspires art installation at Edward Street Quarter

Ship’s hull inspires art installation at Edward Street Quarter -

Welcome 2022!

Welcome 2022! -

Our proudest moments in Brighton in 2021

Our proudest moments in Brighton in 2021 -

Join Bristol businesses and commit to net zero by 2030

Join Bristol businesses and commit to net zero by 2030 -

Socius and Patron comment on £180m MK Gateway planning

Socius and Patron comment on £180m MK Gateway planning -

Construction progress at Edward Street Quarter

Construction progress at Edward Street Quarter -

Introducing Socius Development Limited

Introducing Socius Development Limited -

Formal Announcement about Socius

Formal Announcement about Socius